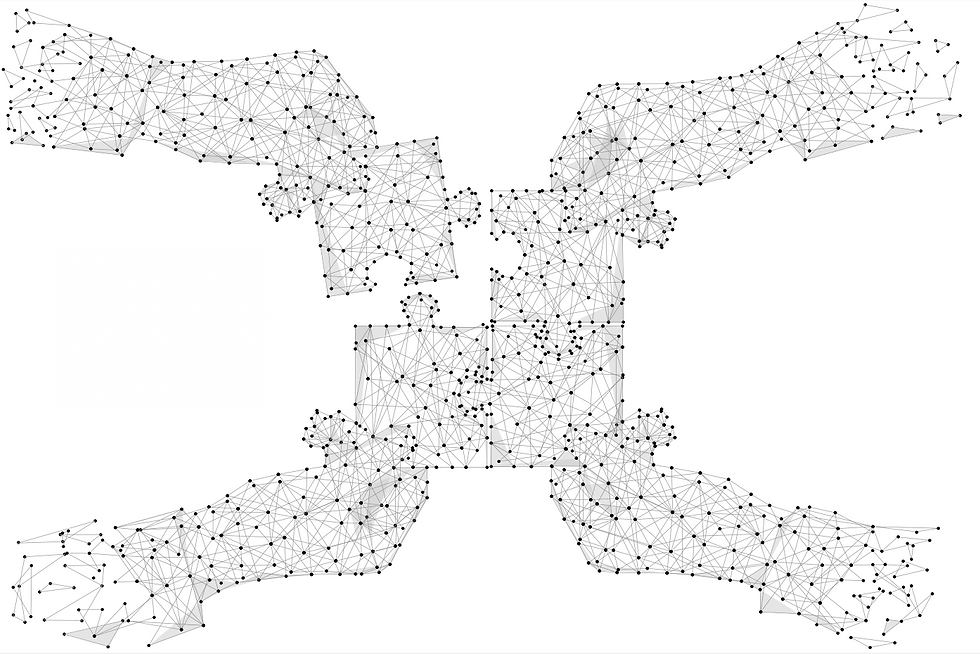

With apologies to the late American novelist Flannery O’Connor for the title of this piece, consolidation can be defined as the process of uniting – making something stronger or more solid. One of the principal stories of the US healthcare industry over the past several years is one of consolidation. Payers, pharmaceutical manufacturers, pharmacies, and providers have all consolidated at a rapid rate. Our focus today is on hospital systems, physician practices, and health insurance companies. Has consolidation among these players made our healthcare system stronger or more solid? As with many things in life, it depends. Congress and regulators (such as the Federal Trade Commission (FTC)) are tasked with evaluating potential deals in the context of how they might serve the greater good.

First, it’s important to consider the type of consolidation at hand. Horizontal consolidation occurs when two entities that perform similar functions combine (for example, two Dallas-based cardiology practices merge with one another), and vertical integration refers to one type of organization merging with another in the supply chain (for example, a health insurance company buys a pharmacy benefit manager (PBM)). Both types of integration can help organizations reduce costs and/or increase efficiencies overall, however, they can also lead to a loss of competition, increased costs, and lower quality of care.

On April 26th, California-based Kaiser Permanente and Pennsylvania’s Geisinger Health announced the launch of Risant Health. This new organization is designed to be an independently operated, non-profit community health system focused on, among other things, leveraging technology and investing in preventive care. This consolidation of Kaiser’s 39 hospitals and 24,000 physicians with Geisinger’s 10 hospitals and 1,600 physicians will help position Risant for a healthcare system increasingly built around value-based care models. Regulators, who are generally concerned about horizontal consolidation of health systems within the same market, are expected to approve this deal given its geographic diversity.

Solo and small groups of physicians have largely been replaced by multi-specialty groups and practices owned by hospitals. According to a recent Avalere study, the percentage of physicians employed by a healthcare system jumped from about 28% in 2010 to about 74% in 2021. Given this shift, regulators are faced with balancing the promises of vertical integration (improved efficiencies, enhanced coordination of care, improved health outcomes) with potential antitrust concerns (physicians favoring their owners’ facilities and thereby reducing competition).

Consolidation has also been at play among US health insurers. Between 2006 and 2014, the market control of the four largest insurers (Aetna, Blue Cross Blue Shield, United, and Anthem) increased from 74% to 83% according to Professor Leemore S. Dafny. However, an evaluation by the National Bureau of Economic Research (NBER) evaluated the impact of consolidation among health insurance companies and determined it had a relatively small impact on the cost of health insurance premiums. Yet health insurance costs have increased significantly – one culprit could be vertical integration, which is certainly on regulators’ collective radar scopes.

Waves of mergers and acquisitions in the healthcare industry have led to increased consolidation and costs. Regulators are challenged with striking a balance between organizations’ drive to expand and maintenance of competitive markets so that costs and quality are optimized for patients. Congress and the FTC need to take steps to understand the impact of consolidation to help achieve that balance. With our focus on Better Healthcare Tomorrow™, we will continue to study the healthcare industry closely.

Comments